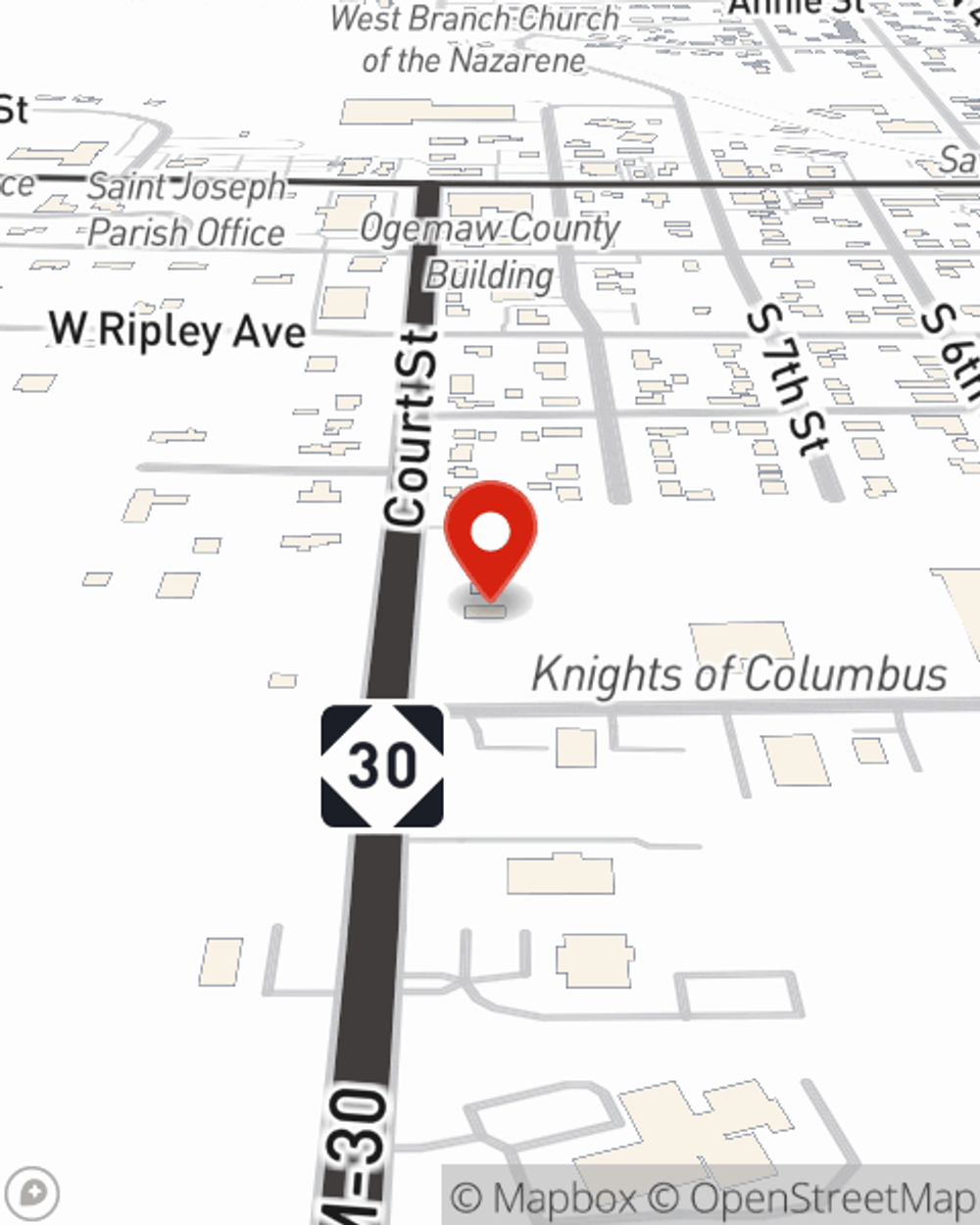

Condo Insurance in and around West Branch

Get your West Branch condo insured right here!

State Farm can help you with condo insurance

Would you like to create a personalized condo quote?

- Saint Helen

- Prescott

- Roscommon

- Standish

- Au Gres

- linwood

- Bay City

- Ogemaw County

- Arenac County

- Bay County

- Houghton Lake

- Hale

- Higgins Lake

- Essexville

- Kawkawlin

- Tawas City

- East Tawas

- Mio

- Iosco County

- Gladwin

- Auburn

- Freeland

- Saginaw

Your Search For Condo Insurance Ends With State Farm

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected catastrophe or mishap. And you also want to be sure you have liability coverage in case someone stumbles and falls on your property.

Get your West Branch condo insured right here!

State Farm can help you with condo insurance

Safeguard Your Greatest Asset

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance is necessary for many reasons. It protects both your condo and your valuable possessions. In the event of a tornado or vandalism, you might have damage to the items inside your condo in addition to damage to the structure itself. Without insurance to cover your possessions, you might not be able to replace your valuables. Some of your possessions can be covered if they are damaged even if you take them outside of your condo. If your car is stolen with your computer inside it, a condo insurance policy might help you replace it.

If you want to get started, State Farm agent Brandon Sutkowi is ready to help! Simply contact Brandon Sutkowi today and say you are interested in this excellent coverage from one of the top providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Brandon at (989) 345-0225 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Brandon Sutkowi

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.